At 7:58 a.m., the clinic is already full and your billing team has 120 claims “ready to send.” By 10:12 a.m., the dashboard tells a different story: eligibility denials, coding errors, missing prior auths. This isn’t a “paperwork” problem—it’s cash not coming in, duplicate work, and patients waiting on reimbursements.

The data backs up the sense of crisis in revenue cycle management (RCM): in 2024, initial rejection rates hovered around 11.8% across the industry and trended upward. Medicare Advantage has been measured at 17% denials on first submission, while ACA marketplace plans averaged roughly 20%, with some insurers reaching as high as 33%. That’s billions “stuck” due to administrative friction. (OS Healthcare)

On the flipside, automation and analytics are already cutting time and cost across RCM processes. The 2024 CAQH Index estimates an additional $20B savings opportunity if the industry accelerates the shift from manual tasks to electronic/automated workflows; automation helped avoid $222B in administrative

spend in 2024 alone. (caqh.org)

The problem, in plain language

- “Simple” mistakes, expensive consequences. A single mistyped digit in eligibility or a missing attachment can sink an entire claim. Evidence shows denials are rising and getting harder to manage (more audits, shifting payer rules). (fiercehealthcare.com)

- The rework treadmill. Every denial means rebuilding records, recoding, appealing. That burns hours your team could spend accelerating clean revenue. (Experian reports more organizations now living with ≥10% denial

rates.) (experianplc.com)

Why AI works like a 24/7 “internal auditor”

AI doesn’t replace your team—it unlocks it. Think of an auditor who checks everything before the payer ever sees it:

1. Pre-submission checks.

Detect missing items (auths, clinical docs, signatures), validate eligibility, and enforce payer-specific rules before transmitting the claim. Result: more clean claims and fewer round-trips. (With 2025 denial pressure rising, this

pre-check has outsized ROI.) (OS Healthcare)

2. Coding and CDI with a magnifying glass.

Suggest more accurate codes/diagnoses, flag clinical inconsistencies, and raise medical necessity risks. Stronger documentation ties directly to fewer downstream denials. (Health Affairs)

3. Denial prediction.

Models flag, by payer and service line, which claims have high rejection risk (e.g., specific CPT+DX combos, required clinical attachments). RCM teams prioritize these files before submission. (Vendors report substantial

gains here.) (Business Insider)

4. Appeals at scale.

AI-assisted drafts pull relevant guideline citations and payer policy text, extract key paragraphs from clinical notes, and assemble “ready-to-send” packets. (New tools are even helping providers counter automated payer

denials.) ( The Guardian )

A note on the “up to 40%”: Industry players report 30–40% reductions in denials when combining prediction + pre-submission verification + automated policy adherence. These are industry results (not meta-analyses), but they point to the direction and potential when paired with sound governance. (athelas.com)

A brief, realistic case

Before: 18% initial denials in ambulatory surgery; +12 days in A/R due to retries.

Intervention (8 weeks):

- Payer-specific rules engine (auths/attachments),

- Risk prediction by service line,

- Appeal templates with auto-extraction of clinical evidence.

After: 12% initial denials (–6 pp), +9% first-pass yield, –5 days in A/R. (Patterns consistent with sector benchmarks.) (OS Healthcare)

What to measure (and how to brief the CFO)

- Initial denial rate (%) by payer/service line

- First-Pass Yield (%).

- Overturn rate (appeals won)

- Cost per reworked claim (hours × cost/hour)

- Days in A/R by payer

- Top-10 root causes (medical necessity, eligibility, attachments, coding,

prior auth)

With 4–6 weeks of data you can build a value case: hours freed, cash accelerated, probability-weighted recoveries on previously lost revenue.

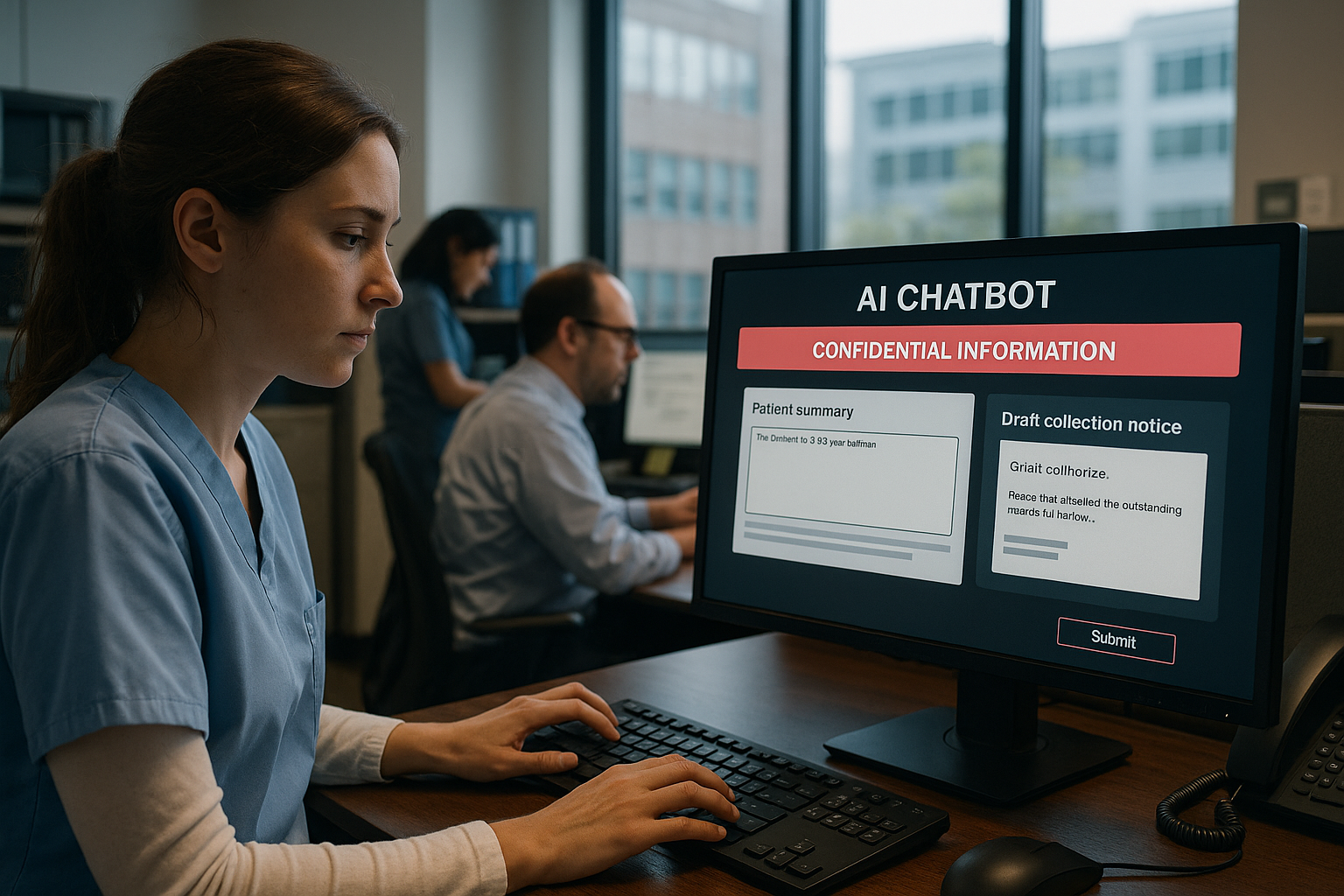

Where HarmoniMD + CLARA fit

- HarmoniMD (cloud HIS/EHR): HL7/FHIR connectors, payer/service worklists and templates, full change traceability, and BI dashboards.

- CLARA (AI assistant): helps clinical documentation (verifiable summaries), extracts evidence for appeals, and adds contextual validations in-flow—without pulling clinicians out of the EHR.

Conclusion

Denials aren’t “bad luck.” They are patterns—and AI can spot them before they

cost you money. With payer rules, pre-submission verification, prediction, and

assisted appeals, your RCM shifts from firefighting to loss prevention. In 2025,

your best auditor doesn’t sleep: it reads, cross-checks, predicts, and documents at

the pace payers demand.

Want to see this on your own data?

Book a HarmoniMD + CLARA demo or let’s map a plan with clear denials, FPY,

and A/R targets. denials, FPY and clear AR.