Healthcare analytics has moved beyond “dashboard projects” to a strategic capability: understanding demand, anticipating clinical risk, reducing denials, and optimizing resources. Below is a snapshot of market size and, the forces pushing BI adoption on the clinical–operational front.

1) How big is the healthcare analytics market?

- Global. Recent estimates put the global market at USD 52.98B (2024) with a projection to USD 198.79B by 2033 (≈ 14.9% CAGR). (Grand View Research) Other analysts estimate USD 57.16B (2025) reaching USD

160.39B (2030) (≈ 22.9% CAGR)—dispersion aside, the growth trend is clear. (Mordor Intelligence) - Latin America. In 2024, LATAM generated USD 1.60B in healthcare analytics with ~16% CAGR (2025–2033); Mexico is expected to outpace the region. (Grand View Research). A second view sizes LATAM at USD 1.01B

(2024) with ~19.1% CAGR (2025–2033). ( Market Data Forecast )

Executive read: Demand is accelerating, moving to cloud, and expanding from descriptive reporting into predictive/prescriptive analytics.

2) Why is demand for clinical-operational BI rising?

a) Financial pressure & more complex revenue cycles

Hospitals report expenses rising faster than reimbursement, pushing leaders to optimize operations and revenue cycle. (American Hospital Association)

At the same time, initial denials climbed to ~11.8% in 2024, increasing the need for root-cause analytics and near-real-time RCM dashboards. (os-healthcare.com)

b) Digital maturity & data governance focus

The CHIME Digital Health Most Wired 2024 Trends Report highlights rising IT budgets, stronger data governance, and record levels of tech adoption—fueling analytics programs. (KLAS Research)

c) AI in workflow needs trustworthy data (and metrics)

86% of health systems report using AI in some form; 60% see AI spotting patterns beyond human detection—raising the bar for data quality and impact measurement. (himss.org)

d) Regulations that demand transparency

The US ONC HTI-1 rule adds algorithmic transparency requirements for certified Decision Support Interventions (DSI)—another reason to strengthen lineage and evidence sources in BI. (healthit.gov)

e) Market signals (clients &; vendors)

Demand for healthcare data and analytics services continues to buoy vendor results, reinforcing a sustained adoption narrative. (Reuters)

3) Use cases delivering ROI today (and what to measure)

1. Flow & hospital productivity (ED/OR/inpatient). Cycle-time dashboards, LOS prediction, and early-discharge worklists.

KPIs: door-to-doctor, case-mix-adjusted LOS, occupancy, % discharges before 11:00.

2. RCM & denials. Root-cause analytics by payer/service; coverage eligibility and prior-auth tracking; early warning for at-risk accounts.

KPIs: denegaciones iniciales, overturn rate, DSO, costo por reclamo. (os- healthcare.com)

3. Quality & patient safety. Monitoring clinical alerts and medication reconciliation; early signals for adverse events.

KPIs: ADEs per 1,000 patient-days, acceptance of high-value alerts, complete reconciliation at discharge.

4. Patient experience. No-shows by cohort, portal-based rebooking, time-to- appointment, digital payments.

KPIs: no-show rate, % digital payments, NPS/satisfaction—and link to ROI on portal/reminders.

5. AI for documentation & decision support. Time-in-EHR, note quality, and DSI transparency attributes (HTI-1) for traceability. (healthit.gov)

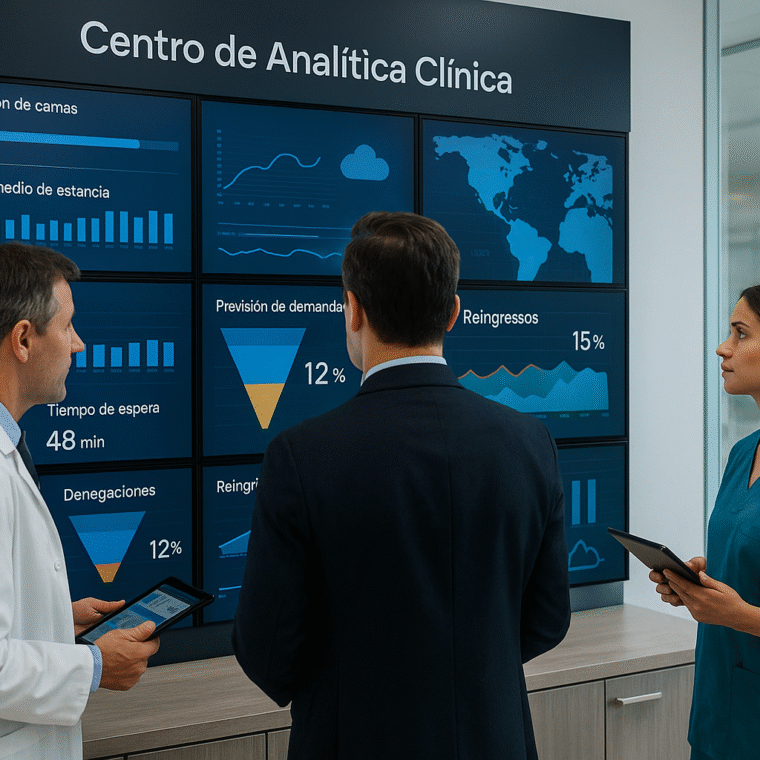

4) Minimum architecture for clinical-operational BI

- EHR/EMR as the transactional layer; FHIR/HL7 integration.

- Data lake/warehouse with lineage and version control.

- BI tools (service-level dashboards) and pipeline orchestration.

- Catalog & governance (data owners, quality policies).

- Security metrics (access, encryption, backups, RTO/RPO).

Most Wired 2024 trend materials underscore that rising IT budgets are flowing to infrastructure, automation, and governance so data becomes decisions. (KLAS Research)

Conclusion

The size and growth of healthcare analytics isn’t a fad: it reflects real financial pressure, digital maturity, AI adoption, and transparency rules that force better measurement. Hospitals that standardize KPIs, run with governance, and wire analytics into daily actions (worklists, alerts, service dashboards) turn their EHR

into an operational and financial engine.

Want to see this applied to your reality?

Book a HarmoniMD + CLARA demo (HarmoniMD’s AI-powered assistant), or let’s talk about your project and shape a modular plan with clear clinical and operational goals.